Non-Alcoholic Beverages Sourcing and Procurement Report by Top Spending Regions and Market Price Trends - Forecast and Analysis 2022-2026

| Published: Oct 2022 | Pages: 143 | SKU: IRCMSTR21227 |

Non-Alcoholic Beverages Procurement - Sourcing and Intelligence Report on Price Trends and Spend & Growth Analysis

The non-alcoholic beverages procurement category is projected to grow at a CAGR of 6.12% during 2022-2026. The prices are outlined to rise by 6%-7% during the forecast period and suppliers will have high bargaining power in this market. PepsiCo Inc., The Coca-Cola Co., and Nestlé SA are a few of the key suppliers in the non-alcoholic beverages market.

To unlock the YoY growth values for 2022-2026, Request for a FREE Sample Report!

Who are the Top Suppliers in the Non-Alcoholic Beverages Market?

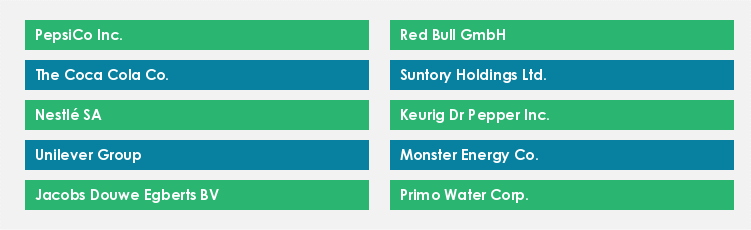

This report offers detailed insights and analysis of the major cost drivers, volume drivers, and innovations of the non-alcoholic beverages procurement and sourcing market, which the global suppliers have been leveraging to gain a competitive edge across regions. Some of the leading non-alcoholic beverages suppliers profiled extensively in this report include:

Furthermore, this non-alcoholic beverages procurement market report provides a detailed analysis of procurement strategies deployed by major category end-users across several industries while sourcing for non-alcoholic beverages requirements. In addition, most adopted and high-potential pricing models considered by buyers have been analyzed in this report, which will help understand business scopes for revenue expansion. These data will assist buyers to realize cost savings and identify business strategies to improve sales.

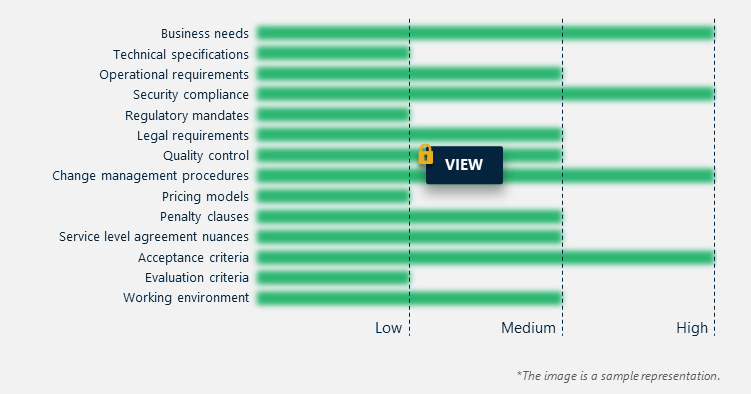

What are the Most Suitable Supplier Selection Criteria, Supplier Evaluation Metrics, and SLA that Buyers Should Consider?

The non-alcoholic beverages procurement market report provides a detailed analysis of various supplier selection criteria, RFX questions, supplier evaluation metrics, and the service level agreements that the buyers should consider adopting to achieve significant cost savings, streamline the procurement process, and reduce category TCO while sourcing for non-alcoholic beverages requirements.

To get the exact category management parameters and unfold their degree of influence on this non-alcoholic beverages procurement market in details, Get the FREE Sample Report Now!

What are the Most Adopted Procurement Strategies by Buyers Across Industries?

The report provides a detailed insight of the most adopted procurement strategies by buyers across industries and an analysis of these strategies with respect to innovation, regulatory compliance, quality, supply, and cost. Adoption of these procurement strategies will enable the buyers to reduce category TCO and achieve cost savings, while sourcing for non-alcoholic beverages requirements.

What are the Major Pricing Models Adopted by Buyers in the Non-Alcoholic Beverages Market?

The report discusses in detail each pricing model and the pros and cons attached to every pricing model prevalent in the market. Also, the report provides insights with respect to the category supply chain and the margins of various suppliers within the supply chain. These market analysis data will enable the buyers to make informed strategic sourcing decisions. Buy the full non-alcoholic beverages procurement market report now to get comprehensive details on pricing models

Price Strategies and Benchmark

Request for a FREE sample to access the latest price forecasts, market drivers, and TCO reduction opportunities for the non-alcoholic beverages market

To optimize the value of the purchase, it is crucial to keep a track of current and future price trends. Price forecasts are beneficial in purchase planning, especially when supplemented by the constant monitoring of price-influencing factors. During the forecast period, the market expects an incremental spend of USD 304.22 billion due to various market drivers prevalent across multiple regions. Also, the report speaks about various cost-saving factors through analysis of the following factors:

- Identify favorable opportunities in non-alcoholic beverages TCO (total cost of ownership)

- Expected changes in price forecast and factors driving the current and future price changes

- Identify pricing models that offer the most rewarding opportunities

What will the Spend Growth and Demand be by Region?

The non-alcoholic beverages market will register an incremental spend of about USD 304.22 billion during the forecast period. However, only a few regions will drive the majority of this growth. Moreover, on the supply side, North America, Europe, and APAC will have the maximum influence owing to the supplier base. The growth is expected to be primarily driven by increasing demand and adoption of the category across those few regions. To get a detailed analysis of the volume drivers driving the adoption of the category across regions, buy the full report now!

The drivers and inhibitors that influence these global and regional outlooks are elaborated on in detail in this procurement report. Our in-depth growth decomposition analysis covers details on:

- Factors driving the growth (or lack of it) in individual geographies

- Regions that hold the most rewarding opportunities for buyers and suppliers

- Spend growth and regional spend segmentation over the coming years

Request for a FREE sample for more information on the spend growth for the non-alcoholic beverages procurement market

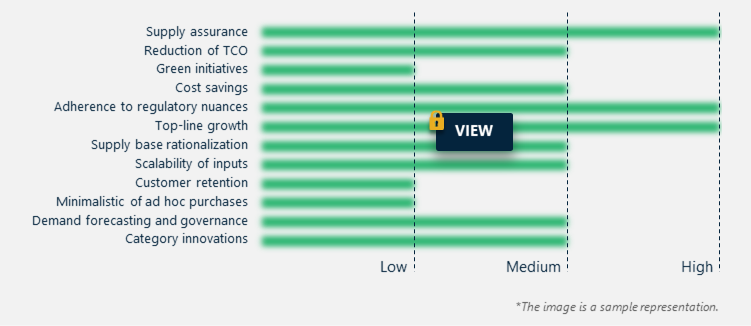

What are the Major Category Management Objectives for Non-Alcoholic Beverages Sourcing?

A targeted strategic approach to non-alcoholic beverage sourcing will provide several opportunities. However, in the absence of actionable intelligence on non-alcoholic beverages, buyers may end up focusing on a tactical sourcing strategy without any focus on cost-saving opportunities. Hence, this report focuses on category management initiatives such as top-line growth, scalability of inputs, and green initiatives, which will assist buyers to formulate a strategic procurement strategy

The report explains the following key category management objectives that should form the base for sourcing strategy.

To explore the extent of influence of category management objectives that can improve the efficiencies of the retailers, Request for a FREE Sample Report!

In addition to helping buyers in identifying the strategic goals and initiatives for category management, the report also has detailed insights into the most outsourced category management activities and category enablers which can simplify the procurement process for buyers.

|

Scope of Non-Alcoholic Beverages |

|

|

Report Specs |

Details |

|

Page number |

143 |

|

Base year |

2021 |

|

Forecast period |

2022-2026 |

|

Spend growth (CAGR) |

6.12% |

|

Incremental spend |

USD 304.22 billion |

|

Pricing growth outlook |

6%-7% |

|

Pricing models |

Market penetration pricing and Psychological pricing |

|

Supplier selection scope |

Logistics and storage capabilities, Quality of packaging, Software and IT-related infrastructure, and Pricing terms |

|

Supplier opportunities |

Top-line growth, Scalability of inputs, Green initiatives, Category innovations, Supply base rationalization, Demand forecasting and governance, Minimalization of ad hoc purchases, Adherence to regulatory nuances, Cost savings, Customer retention, Reduction of TCO, and Supply assurance |

|

Supplier selection criteria |

Business needs, Technical specifications, Operational requirements, Security compliance, Regulatory mandates, Legal requirements, Quality control, Change management procedures, Pricing models, Penalty clauses, SLA nuances, Acceptance criteria, and Evaluation criteria |

|

Category management scope |

Top-line growth, Scalability of inputs, Green initiatives, Category innovations, Supply base rationalization, Demand forecasting and governance, Minimalization of ad hoc purchases, Adherence to regulatory nuances, Cost savings, Customer retention, Reduction of TCO, and Supply assurance |

|

Top suppliers |

PepsiCo Inc., The Coca Cola Co., Nestlé SA, Unilever Group, Jacobs Douwe Egberts BV, Red Bull GmbH, Suntory Holdings Ltd. , Keurig Dr Pepper Inc., Monster Energy Co., Primo Water Corp., and The Kraft Heinz Co. |

|

Market dynamics |

Regional category spend in terms of percentage with respect to North America, South America, Europe, Middle East and Africa and APAC and global category spend and CAGR in terms of percentage over a span of 5 years. |

|

Customization scope |

We can create customized sourcing/procurement reports with specific requirements for your business. |

Executive Summary

- Executive Summary

Market Insights

- Global category spend

- Spend segmentation by region

- Regional spend dynamics

- Regional influence on global spend

- Regional spend opportunity for suppliers

Category Pricing Insights

- Pricing

- Discounts on Prices

- Pricing outlook

- Supplier cost structure

- Overview of pricing models

- Comparison of pricing models

- Supply chain margins

- Cost and Volume drivers: Impact on pricing

Cost-saving Opportunities

- Cost-saving levers

- Quantifying cost-saving opportunities

- Quantifying cost savings by negotiation strategies

- Tactical cost saving levers

- Strategic cost saving levers

Best Practices

- Innovation and success stories

- Procurement excellence best practices

- Procurement best practices

- Sustainability practices

Category Ecosystem

- Market favorability index for suppliers

- Threat of rivalry

- Buyer power

- Supplier power

- Threat of new entrants

- Threat of substitutes

- Buyer ecosystem

- Supplier ecosystem

- Ecosystem disruption threats

Category Management Strategy

- Strategy objectives

- Supplier and buyer KPI's

- Outsourcing category management activities

- Outsourcing category management activities

- Risk management

- Risk management

Category Management Enablers

- Procurement organization

- Category enablers

Suppliers Selection

- RFx essentials

- Supplier selection criteria

- Service level agreement

- Incumbent supplier evaluation metrics

Suppliers under Coverage

- Suppliers covered

- Market positioning of suppliers

- Market positioning of suppliers

- PepsiCo Inc.

- The Coca Cola Co.

- Nestlé SA

- Unilever Group

- Jacobs Douwe Egberts BV

- Red Bull GmbH

- Suntory Holdings Ltd.

- Keurig Dr Pepper Inc.

- Monster Energy Co.

- Primo Water Corp.

- The Kraft Heinz Co.

US Market Insights

- Category spend in the US

- Pricing outlook in the US

- Category margins

- Category cost drivers

- Category volume drivers

- Overview of best practices in the US

- US supply market overview

- Market positioning of suppliers

- Market positioning of suppliers

- Regional category risks

- Regional category risks

Category Scope

- Category scope

Appendix

- List of abbreviations

- Key notes

Research Framework

SpendEdge presents a detailed picture of the market by way of study, synthesis, and summation of data from multiple sources. The analysts have presented the various facets of the market with a particular focus on identifying the key category influencers. The data thus presented is comprehensive, reliable, and the result of extensive research, both primary and secondary.

INFORMATION SOURCES

Primary sources

- Procurement heads

- Category managers

- Sourcing consortium professionals

- Procurement managers

- Category heads of suppliers

- Client account heads/managers

- Client and industry consultants

Secondary sources

- Industry journals and periodicals

- Periodicals and new articles

- Category webinars

- Industry and government websites on regulations and compliance

- Internal databases

- Industry blogs/thought leader briefings

DATA ANALYSIS

PURCHASE FULL REPORT OF

Non-Alcoholic Beverages Sourcing and Procurement Report by Top Spending Regions and Market Price Trends - Forecast and Analysis 2022-2026