Production Chemicals Sourcing and Procurement Report by Top Spending Regions and Market Price Trends - Forecast and Analysis 2020-2024

| Published: Jan 2021 | Pages: 120 | SKU: IRCMSTR22005 |

Production Chemicals Procurement - Sourcing and Intelligence Report on Price Trends and Spend & Growth Analysis

The production chemicals will grow at a CAGR of 5.14% during 2020-2024. Prices will increase by 3%-7% during the forecast period and suppliers will have a moderate bargaining power in this market. Baker Hughes Co., BASF SE, Halliburton, Schlumberger Ltd., Akzo Nobel NV, ExxonMobil, Croda International Plc, Clariant, Solvay, and Lubrizol Corp. are among the prominent suppliers in production chemicals market.

Who are the Top Suppliers in the Production Chemicals Market?

Browse table of contents & list of exhibits and sample illustrations on spend growth, pricing trends, etc.

Request for a FREE sample now!

Leading global suppliers can assist buyers in realizing high-cost savings through their efforts on areas such as vertical integration, horizontal integration, reducing total ownership cost, negotiate on pricing and contractual terms, adoption of automation, managing labor price volatility, cost of quality impact, quality management, and total life cycle cost. Collaborations with global suppliers will also help buyers in cost-saving and ensuring high-quality procurement in the dynamic market.

This report offers key advisory and intelligence to help buyers identify and shortlist the most suitable suppliers for their equipment finance requirements. Some of the leading equipment finance suppliers profiled extensively in this report include:

- Baker Hughes Co.

- BASF SE

- Halliburton

- Schlumberger Ltd.

- Akzo Nobel NV

- ExxonMobil

- Croda International Plc

- Clariant

- Solvay

- Lubrizol Corp.

Supplier Selection and Evaluation

Profile and service capabilities of the service provider, industry specialization of the service providers, reputation of service providers, and assessment of value-added services are some of the most critical parameters that buyers use to shortlist the suppliers in equipment finance.

This report evaluates suppliers based on comprehensiveness of product and service portfolios, ability to provide data capturing and analytics support, ability of suppliers to provide expert consultation on chemical selection and use, and technical expertise of suppliers. In addition, suppliers are also shortlisted based on business needs, technical specifications, operational requirements, security compliance, regulatory mandates, legal requirements, quality control, change management procedures, pricing models, penalty clauses, SLA nuances, acceptance criteria, and evaluation criteria.

What are the Major Pricing Trends in Production Chemicals Procurement?

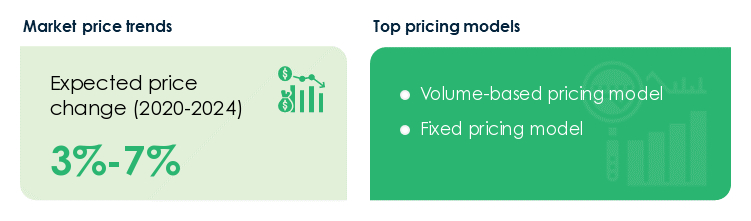

The pressure from substitutes and a low level of threat from new entrants has resulted in the moderate bargaining power of suppliers. This makes it extremely important to get the pricing and pricing model right. Buyers should align their preferred pricing models for production chemicals with the wider industry and identify the cost-saving potential.

Volume-based pricing model and fixed pricing model are the most widely adopted pricing models in the production chemicals. Each pricing model offers optimum benefits and fitment in specific situations. Buyers should identify the model that suits their operations in the best manner and link supplier performance to the pricing models.

Price Strategies and Benchmark

Request for a FREE sample to access the definite purchasing guide on production chemicals procurement

To optimize the value of the purchase it is crucial to a keep track of current and future price trends. Price forecasts are beneficial in purchase planning, especially when supplemented by the constant monitoring of price influencing factors. During the forecast period, the market expects a change of 3%-7%.

- Identify favorable opportunities in production chemicals TCO (total cost of ownership)

- Expected changes in price forecast and factors driving the current and future price changes

- Identify pricing models that offer the most rewarding opportunities

Will there be an Increase in the Spend Growth for Production Chemicals Procurement?

The report provides a complete drill-down on global equipment finance spend outlook at a global as well as regional level. Current spend scenario, growth outlook, incremental spend, and other key information is available individually for North America, South America, Europe, Middle East and Africa, and APAC.

Spend Growth and Demand Segmentation

Request for a FREE sample for more information on the spend growth for production chemicals procurement

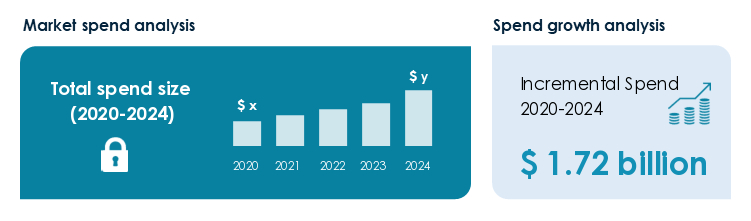

The production chemicals market will register an incremental spend of about $ 1.72 billion during the forecast period. Only a few regions will drive the majority of this growth. On the supply side, North America, South America, Europe, Middle East and Africa, and APAC will have the maximum influence owing to the supplier base.

The drivers and inhibitors that influence these global and regional outlooks are also elaborated in detail. Our in-depth growth decomposition analysis covers details on:

- Factors driving the growth (or lack of it) in individual geographies

- Regions that hold the most rewarding opportunities for buyers and suppliers

- Is the spend growth cyclical and when will the growth curve peak?

What are the Major Category Management Objectives for Production Chemicals Sourcing?

A targeted strategic approach to production chemicals sourcing will provide several opportunities to buyers. However, in the absence of actionable intelligence on production chemicals, buyers have resulted in a transaction-based approach towards the category. The buyers have a moderate bargaining power in this market and a holistic category management approach will help buyers maximize the value on their equipment finance procurement.

The report explains key category management objectives that should form the base for sourcing strategy, including:

- Top-line growth

- Scalability of inputs

- Green initiatives

- Supply base rationalization

- Demand forecasting and governance

- Minimalization of ad hoc purchases

- Adherence to regulatory nuances

- Cost savings

- Customer retention

- Reduction of TCO

- Supply assurance

- Category innovations

In addition to helping buyers in identifying the strategic goals and initiatives for category management, the report will also help create the necessary support structure to facilitate implementation. This report provides in-depth inputs on streamlining category management practices and provides detailed answers on:

- The strategic sourcing objectives, activities, and enablers for production chemicals category

- Production chemicals procurement best practices to promote in my supply chain

Best Practices

Executive Summary

Market Insights

Category Ecosystem

Category Pricing Insights

Category Management Strategy

Category Management Enablers

Cost-saving Opportunities

Suppliers Selection

Best Practices

Suppliers under Coverage

Category Ecosystem

Category Management Strategy

US Market Insights

Category Management Enablers

Category scope

Appendix

Suppliers Selection

Suppliers under Coverage

US Market Insights

Category scope

Appendix

Research Framework

SpendEdge presents a detailed picture of the market by way of study, synthesis, and summation of data from multiple sources. The analysts have presented the various facets of the market with a particular focus on identifying the key category influencers. The data thus presented is comprehensive, reliable, and the result of extensive research, both primary and secondary.

INFORMATION SOURCES

Primary sources

- Procurement heads

- Category managers

- Sourcing consortium professionals

- Procurement managers

- Category heads of suppliers

- Client account heads/managers

- Client and industry consultants

Secondary sources

- Industry journals and periodicals

- Periodicals and new articles

- Category webinars

- Industry and government websites on regulations and compliance

- Internal databases

- Industry blogs/thought leader briefings

DATA ANALYSIS

PURCHASE FULL REPORT OF

Production Chemicals Sourcing and Procurement Report by Top Spending Regions and Market Price Trends - Forecast and Analysis 2020-2024