Get instant access to this report sample and gain complimentary access to our procurement research platform.

Trusted by

The report identifies AISIN SEIKI Co. Ltd., BorgWarner Inc., and Continental AG among the top most important suppliers for automotive transmission system procurement. Suppliers have a moderate bargaining power in a market that is set to grow at 6.42%. Therefore the price of automotive transmission system will increase by 2%-4% during the forecast period.

Several strategic and tactical negotiation levers are explained in the report to help buyers achieve the best prices for automotive transmission system. The report also aids buyers with relevant automotive transmission system pricing levels, pros and cons of prevalent pricing models such as volume-based pricing and cost-plus markup pricing and category management strategies and best practices to fulfill their category objectives.

A targeted strategic approach to automotive transmission system sourcing can unlock several opportunities for buyers. Still, we see that buyers have a pre-dominantly transaction-based approach towards the category and miss out on cost-saving opportunities in the absence of actionable intelligence on automotive transmission system procurement market.

Strategic Sourcing and Enablers

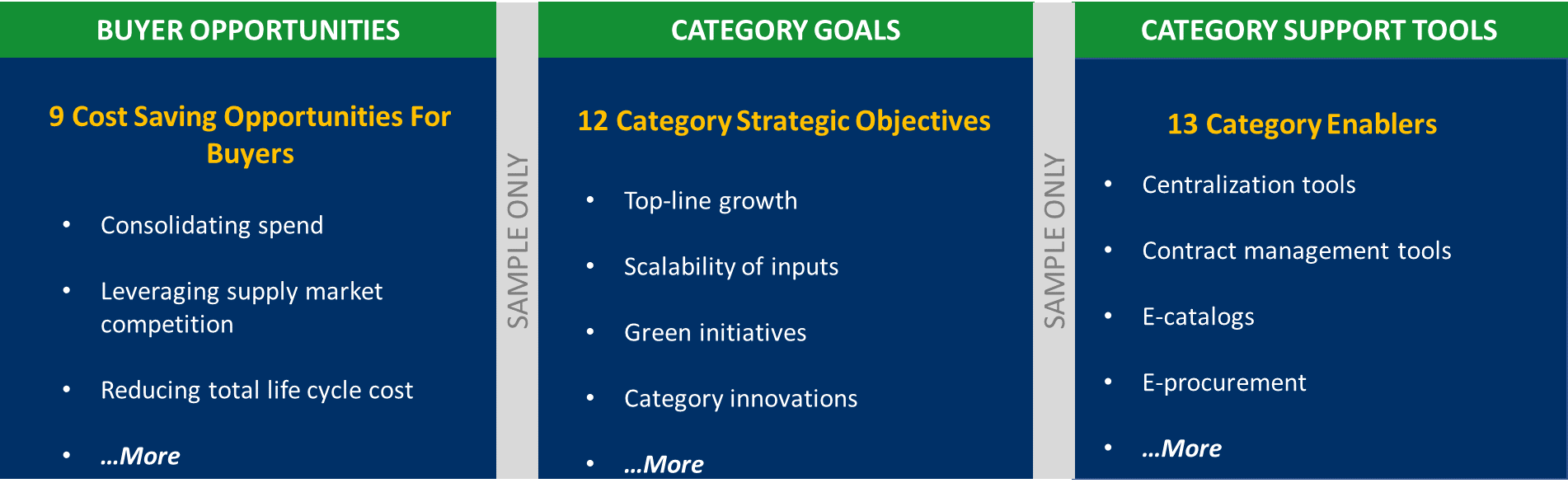

During our interactions with category managers, it is often cited that buyers have a moderate bargaining power in the automotive transmission system market. Our sourcing experts believe that a holistic category management approach can help buyers further maximize the value on their automotive transmission system procurement. The report explains key category management objectives that should form the base for automotive transmission system sourcing strategy, including:

In addition to identifying the strategic goals and initiatives for the category management, it is also important to create the necessary support structure to facilitate their implementation. The report identifies multiple enablers that can help maximize the efficiency of automotive transmission system category management.

This report provides in-depth inputs on streamlining your automotive transmission system category management practices. Request for a FREE sample for detailed answers on:

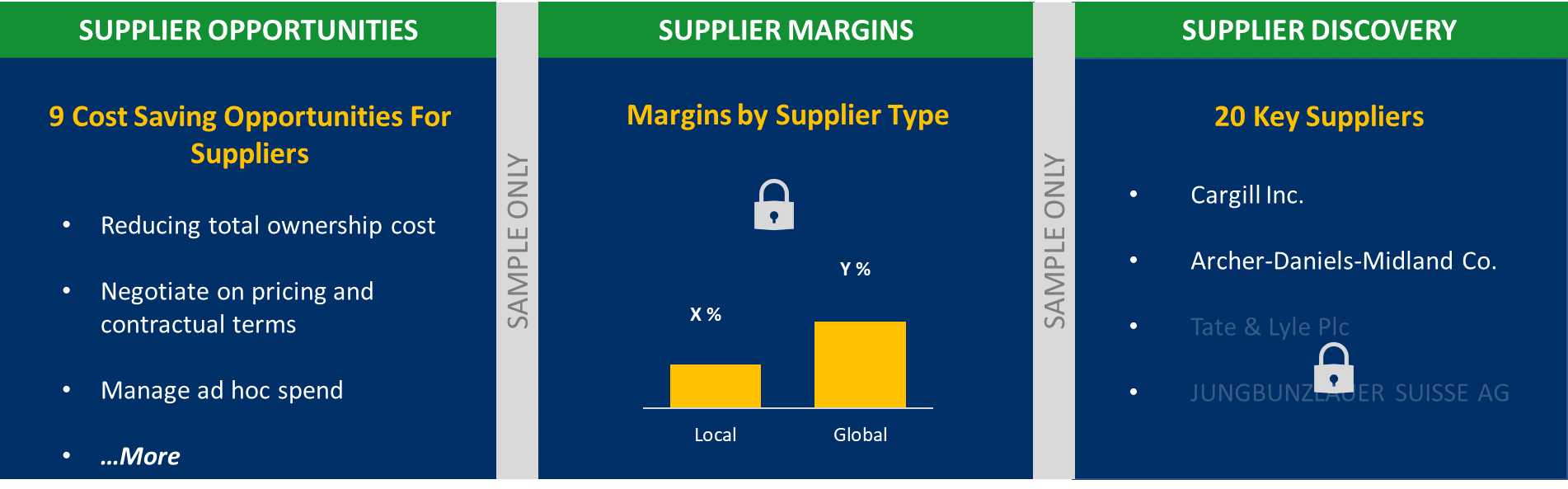

Leading global suppliers can assist buyers in realizing high-cost savings through their efforts on areas such as backward integration, supplier synergies, reducing total ownership cost, conference participation, managing commodity price volatility, negotiate on pricing and contractual terms, ad-hoc spend management, adoption of automation, and quality management. By collaborating with global suppliers, buyers can easily implement cost-saving and assure themselves of high-quality procurement of automotive transmission system during diverse situations.

Key Suppliers and Supplier Management

This report offers key advisory and intelligence to help buyers identify and shortlist the most suitable suppliers for their automotive transmission system requirements. Some of the leading automotive transmission system suppliers profiled extensively in this report include:

Annual order capacity, methodologies used to measure quality, provision of warranty, and oee and teep metrics are some of the most critical parameters that buyers use to shortlist the suppliers in automotive transmission system. Shortlisted suppliers must be carefully evaluated and scrutinized against business needs, technical specifications, operational requirements, security compliance, regulatory mandates, legal requirements, quality control, change management procedures, pricing models, SLA nuances, acceptance criteria, evaluation criteria, and working environment and several other selection criteria described in detail by this report.

Request for a FREE sample for a complete understanding of automotive transmission system supplier landscape:

Suppliers in this market have moderate bargaining power owing to low pressure from substitutes and a high level of threat from new entrants. Therefore, it is extremely important to get the pricing and pricing model right. Buyers can benchmark their preferred pricing models for the automotive transmission system with the wider industry and identify the cost-saving potential.

For example, volume-based pricing and cost-plus markup pricing are the most widely adopted pricing models in the automotive transmission system. Each pricing model offers optimum benefits and fitment in specific situations. Buyers are advised to identify the model that suits their operations in the best manner and link supplier performance to the pricing models.

Price Strategies and Benchmark

Additionally, it is crucial to keep track of current and future automotive transmission system price trends to completely optimize the value of the purchase, both from current cash outflow as well as overall cost and benefit perspective. The automotive transmission system report expects a change of 2%-4% during the forecast period. Price forecasts are beneficial in purchase planning, especially when supplemented by constant monitoring of price influencing factors described in the report.

Pricing insights presented in this report cover pricing benchmarks and the trends and strategies that can help optimize cost savings. Request for a FREE sample to access the definite purchasing guide on the automotive transmission system that answers all your key questions on price trends and analysis:

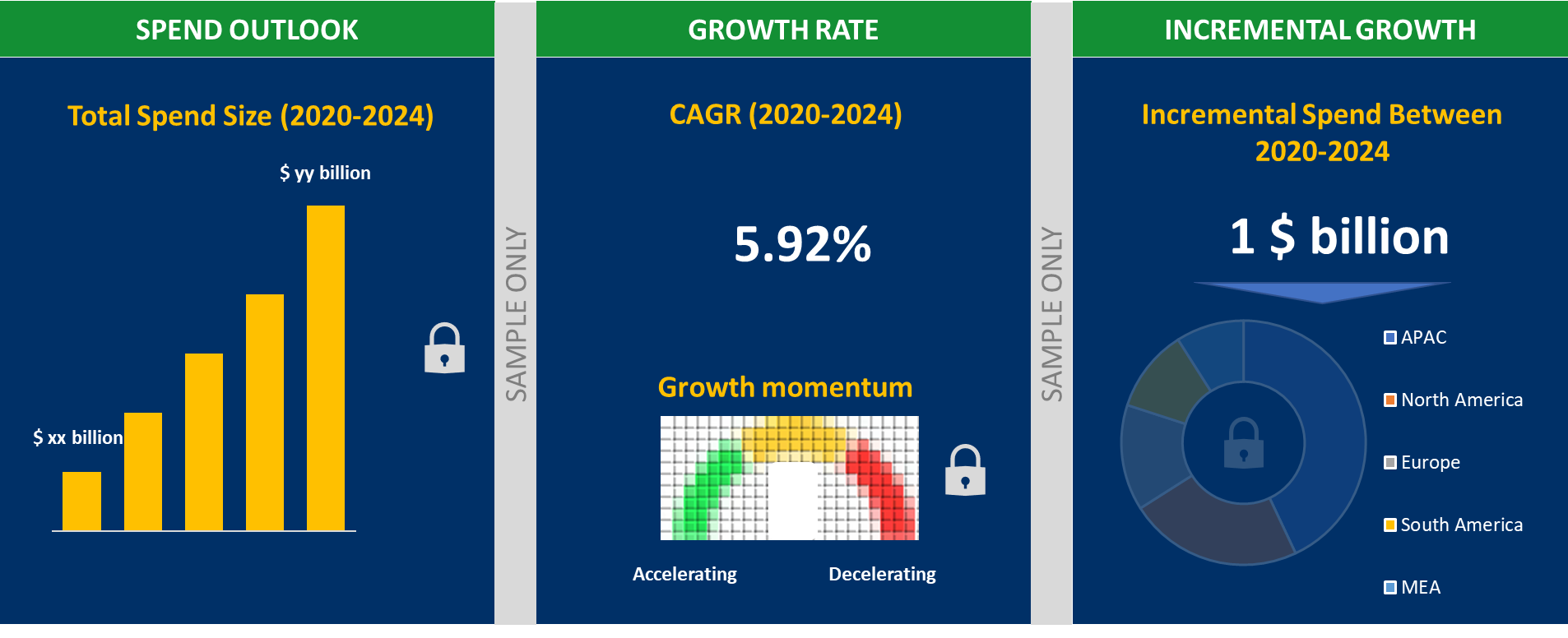

The report provides a complete drill-down on the global automotive transmission system spend outlook at a global as well as regional level. Current spend scenario, growth outlook, incremental spend, and other key information is available individually for North America, South America, Europe, the Middle East and Africa, and APAC.

Spend Growth and Demand Segmentation

The automotive transmission system market will register an incremental spend of about $ 62 billion, growing at a CAGR of 6.42% during the five-year forecast period. Only a handful of regions will drive the majority of this growth. On the supply side, North America, South America, Europe, Middle East and Africa, and APAC will have the maximum influence owing to the supplier base.

The drivers and inhibitors that influence these global and regional outlooks are also elaborated in detail. Request for a FREE sample to access our in-depth growth decomposition analysis:

Copyright © 2026 Infiniti Research Limited. All Rights Reserved. Privacy Notice – Terms of Use – Sales and Subscription

Cookie Policy

The Site uses cookies to record users' preferences in relation to the functionality of accessibility. We, our Affiliates, and our Vendors may store and access cookies on a device, and process personal data including unique identifiers sent by a device, to personalise content, tailor, and report on advertising and to analyse our traffic. By clicking “I’m fine with this”, you are allowing the use of these cookies. You may change your settings based on a legitimate interest at any time, by selecting “Manage Settings” on our site. Please refer to the help guide of your browser for further information on cookies, including how to disable them. Review our Privacy & Cookie Notice.