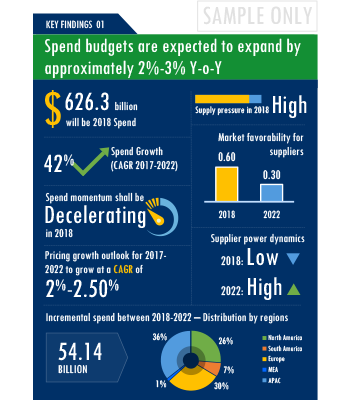

A complete buyer's guide that provides comprehensive insights on Bank Depository Services category spend, spend growth and regional segmentation; in-depth price trends; negotiation levers and analysis of Bank Depository Services suppliers.

GET FREE SAMPLEEcosystem of the global Bank Depository Services category is intertwined with the larger parent market of Financial. Our category definition describes that overall Financial market includes all spend related to the provision of financial services used to fill a skills gap for the defined subject areas where the service requirement includes delivery or implementation.

The market for Financial and its sub-segments such as Bank Depository Services are at an interesting intersection. Suppliers are introducing self-service tools such as virtual agents in their customer service ecosystem to reduce the time and costs incurred by customers to resolve an issue.Lack of skilled in-house manpower continues to be the largest factor for hiring of Bank Depository Services.New locations and vendors are emerging as cost effective suppliers of Bank Depository Services, offering an opportunity to widen the supplier base and gain further negotiation leverage with incumbent suppliers.Trends like these and many others discussed in this report are necessitating a relook at the way Bank Depository Services is procured and the procurement cost saving opportunities that exist.

Bank Depository Services procurement best practices are moving towards a level of sophistication which is typically seen in traditional procurement categories. Category managers now have an attractive opportunity to adapt the best practices seen within this category as well as those being leveraged in other non-related categories. This report summarizes the best practices picked from across multiple categories that could work well for category managers involved with Bank Depository Services procurement strategy. For example, Category managers must ensure that they have clearly identified and listed down potential negotiation levers to maximize the value of their category spend before entering into contract-related discussions with service providers. Common negotiation levers to maximize value include deadlines, terms related to payments, (including fees, expenses, and payment timelines) and assistance required from the buyer's organization. Buyers should engage suppliers that can provide services customized for their industry. Though most suppliers offer services across various industries, category managers should ensure that services can be customized and negotiate on pricing based on the level of required customization. There are increased exposure risks of confidential data such as product and service information, operations, and customer information when engaging a third-party supplier. Buyers must engage with suppliers that use encryption technologies, password protection, access control solutions, and proper training schedules to prevent possible information breach.

Activate your free account to gain easy access to cutting edge research and insights on consumers, emerging price trends, global and regional suppliers.

Bank Depository Services procurement managers also need to proactively identify and mitigate potential risks that can arise in the supply chain or contracts for Bank Depository Services procurement. Some examples include:

For detailed insights and complete access to our report library, activate your free account!

The report is intended to serve as a one-stop reference guide for Bank Depository Services procurement strategy and offers a perfect blend of category basics with deep-dive category data and insights. Therefore, it is ideal for category beginners looking for “Bank Depository Services: Procurement Report 101” as well as for category experts actively tracking the global Bank Depository Services procurement market.

You may have just initiated your research to design a winning Bank Depository Services procurement strategy, or you may be a category expert looking for strategic insights and updated data.Either ways, the report has your requirements covered.

Unlock SpendEdge's comprehensive procurement report collection with ease through our procurement platform.

Procurement decisions can prove to be costly in the absence of careful deliberation and evaluation of every available option. In fact, more than 90% of the decision makers we work with acknowledge that timely availability of up-to-date category intelligence can help them make better purchasing decisions. More than 80% of them believe that in-house category intelligence needs to be updated periodically to achieve full benefits. If you have read so far, we are quite sure you agree!!

The Bank Depository Services procurement report helps take more informed decisions by placing all the critical information and advice at the fingertips of a decision maker. It also specifically answers some of the key questions that we have been routinely asked during our industry outreach initiatives:

SpendEdge Insights has helped procurement professionals and sourcing teams manage multiple spend areas and achieve more than $2 billion in savings. Activate your free account today!

The Bank Depository Services market report offers a complete picture of the supply market and analyzes the category from the perspective of both buyers and suppliers. Analysis of the category trends, procurement best practices, negotiation levers and overall category management strategy advisory are interspersed with in-depth data and commentary on spend outlook, pricing ecosystem and supplier landscape drilled down to a region-level coverage.

A key highlight of this report is the in-depth outlook created on Bank Depository Services procurement spend and pricing trends. The report further delves deep into the aspects of cost structure, total cost of ownership and supplier margins for Bank Depository Services. A dedicated section to supplier profiles and evaluation helps decision makers cast a wider procurement net and identify gaps in existing relationships.

Along with specific category and supplier intelligence, the publication also includes curated insights on Bank Depository Services market trends, price influencers and inherent risks. These insights help the decision makers prepare for market shaping trends in advance and create alternative strategies for changes in the market conditions.

Additionally, the report also advises on the best practices and strategies to manage the Bank Depository Services category efficiently. Negotiation levers and opportunities are explained in detail along with quantification of their potential. Benchmark KPIs for supplier and buyer performance management are also aggregated to better organize the category objectives. Other themes of advisory include ideal procurement organization structure, enablers to achieve KPIs or category objectives and ideal SLAs to have with suppliers.

Our research is complex, but our reports are easy to digest. Quantitative analysis and exhaustive commentary is placed in an easy to read format that gives you an in-depth knowledge on the category without spending hours to figure out “what does it mean for my company?”

SpendEdge presents a detailed picture of Bank Depository Services procurement solutions by way of study, synthesis, and summation of data from multiple sources. The analysts have presented the various facets of the market with a particular focus on identifying the key category influencers. The data thus presented is comprehensive, reliable, and the result of extensive research, both primary and secondary.

Global Asset Sales Of Charged Off Accounts Market - Procurement Intelligence Report

Global Billing and Collections Services Market - Procurement Intelligence Report

Global Bankruptcy Market - Procurement Intelligence Report

Global Probate And Estate Recovery Market - Procurement Intelligence Report

Global Plastic Card Recovery Market - Procurement Intelligence Report

Global Asset Recovery Service Market - Procurement Intelligence Report

Global Debt Sale Market - Procurement Intelligence Report

Global Dues And Memberships Market - Procurement Intelligence Report

Global Remarketing/Auction Market - Procurement Intelligence Report

Access this report and our entire procurement platform | Plans starting from USD 3000/ Year Buy Now

Copyright © 2024 Infiniti Research Limited. All Rights Reserved. Privacy Notice – Terms of Use – Sales and Subscription

Cookie Policy

The Site uses cookies to record users' preferences in relation to the functionality of accessibility. We, our Affiliates, and our Vendors may store and access cookies on a device, and process personal data including unique identifiers sent by a device, to personalise content, tailor, and report on advertising and to analyse our traffic. By clicking “I’m fine with this”, you are allowing the use of these cookies. You may change your settings based on a legitimate interest at any time, by selecting “Manage Settings” on our site. Please refer to the help guide of your browser for further information on cookies, including how to disable them. Review our Privacy & Cookie Notice.