A buying guide for Cutting Compounds category – enriched with research on Cutting Compounds procurement spend patterns, Cutting Compounds pricing intelligence, market dynamics and top suppliers of Cutting Compounds.

GET FREE SAMPLEOur category grouping process defines that the overall Non-Medical Chemicals Minerals and Gases market includes all spend on procurement, transportation, conservation and storage of industrial chemicals, minerals and gases. Spend on similar products for medical and pharmaceutical usage is excluded from this category. Dynamics of the global Cutting Compounds market play out within this wider arena of Non-Medical Chemicals Minerals and Gases market. Therefore, our coverage of the Cutting Compounds category also operates within this broader boundary of the overall Non-Medical Chemicals Minerals and Gases market.

Non-Medical Chemicals Minerals and Gases market around the world is undergoing rapid transitions that have a massive potential to influence the way companies strategize for Cutting Compounds procurement and the cost they have to incur. Suppliers are continuously taking efforts to improve efficiencies and productivity and deploying processes and technologies. Some of these investments are likely to increase their costs in the shorter term, but learnings from other sectors keep the suppliers optimistic about a lean cost structure in the longer run. Procurement costs for Cutting Compounds are highly impacted by an increase in the costs associated with the value chain of Cutting Compounds, such as logistics, labor cost and energy. Additionally, outdated assets are also increasing the cost for suppliers. Technology is improving productivity and creating fresh demand. Convergence of data science, automation tools, 3D printing, robotics, AI and big data has opened up multiple possibilities to better serve customers at a lower operational cost.

The report discusses in detail the best practices that have served well the category managers responsible for Cutting Compounds procurement. For example, Buyers must have a clear understanding of the subcontracting policies, if any, of Cutting Compounds suppliers. Factors such as cost incurred, service quality, adherence to timelines, and regulatory compliance of subcontractors employed by suppliers should be carefully assessed prior to engagement. Buyers should invest in benchmarking studies that help category managers to improve their knowledge on market pricing or billing rates of service providers. This helps them to not only save costs but also increase their negotiation power. Competitive bidding as a cost optimization tool is extremely potent but should be carefully deployed only when there is no significant differentiation among Cutting Compounds suppliers.

Activate your free account to gain easy access to cutting edge research and insights on consumers, emerging price trends, global and regional suppliers.

Cutting Compounds procurement managers also need to proactively identify and mitigate potential risks that can arise in the supply chain or contracts for Cutting Compounds procurement. Some examples include:

For detailed insights and complete access to our report library, activate your free account!

The report is intended to serve as a one-stop reference guide for Cutting Compounds procurement strategy and offers a perfect blend of category basics with deep-dive category data and insights. Therefore, it is ideal for category beginners looking for “Cutting Compounds: Procurement Report 101” as well as for category experts actively tracking the global Cutting Compounds procurement market.

You may have just initiated your research to design a winning Cutting Compounds procurement strategy, or you may be a category expert looking for strategic insights and updated data.Either ways, the report has your requirements covered.

Unlock SpendEdge's comprehensive procurement report collection with ease through our procurement platform.

Procurement decisions can prove to be costly in the absence of careful deliberation and evaluation of every available option. In fact, more than 90% of the decision makers we work with acknowledge that timely availability of up-to-date category intelligence can help them make better purchasing decisions. More than 80% of them believe that in-house category intelligence needs to be updated periodically to achieve full benefits. If you have read so far, we are quite sure you agree!!

The Cutting Compounds procurement report helps take more informed decisions by placing all the critical information and advice at the fingertips of a decision maker. It also specifically answers some of the key questions that we have been routinely asked during our industry outreach initiatives:

SpendEdge Insights has helped procurement professionals and sourcing teams manage multiple spend areas and achieve more than $2 billion in savings. Activate your free account today!

The Cutting Compounds market report offers a complete picture of the supply market and analyzes the category from the perspective of both buyers and suppliers. Analysis of the category trends, procurement best practices, negotiation levers and overall category management strategy advisory are interspersed with in-depth data and commentary on spend outlook, pricing ecosystem and supplier landscape drilled down to a region-level coverage.

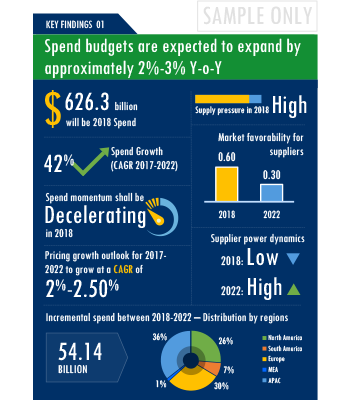

A key highlight of this report is the in-depth outlook created on Cutting Compounds procurement spend and pricing trends. The report further delves deep into the aspects of cost structure, total cost of ownership and supplier margins for Cutting Compounds. A dedicated section to supplier profiles and evaluation helps decision makers cast a wider procurement net and identify gaps in existing relationships.

Along with specific category and supplier intelligence, the publication also includes curated insights on Cutting Compounds market trends, price influencers and inherent risks. These insights help the decision makers prepare for market shaping trends in advance and create alternative strategies for changes in the market conditions.

Additionally, the report also advises on the best practices and strategies to manage the Cutting Compounds category efficiently. Negotiation levers and opportunities are explained in detail along with quantification of their potential. Benchmark KPIs for supplier and buyer performance management are also aggregated to better organize the category objectives. Other themes of advisory include ideal procurement organization structure, enablers to achieve KPIs or category objectives and ideal SLAs to have with suppliers.

Our research is complex, but our reports are easy to digest. Quantitative analysis and exhaustive commentary is placed in an easy to read format that gives you an in-depth knowledge on the category without spending hours to figure out “what does it mean for my company?”

SpendEdge presents a detailed picture of Cutting Compounds procurement solutions by way of study, synthesis, and summation of data from multiple sources. The analysts have presented the various facets of the market with a particular focus on identifying the key category influencers. The data thus presented is comprehensive, reliable, and the result of extensive research, both primary and secondary.

Global Drilling Mud Market - Procurement Intelligence Report

Global Light Oils Market - Procurement Intelligence Report

Global Lubricating Traction Oils Market - Procurement Intelligence Report

Global Petroleum Wax Market - Procurement Intelligence Report

Global White Oils Market - Procurement Intelligence Report

Global Petroleum Residues Market - Procurement Intelligence Report

Global Compressor Lube Oils Market - Procurement Intelligence Report

Global Synthetic Lubricants Market - Procurement Intelligence Report

Global Brake Fluids Market - Procurement Intelligence Report

Access this report and our entire procurement platform | Plans starting from USD 3000/ Year Buy Now

Copyright © 2024 Infiniti Research Limited. All Rights Reserved. Privacy Notice – Terms of Use – Sales and Subscription

Cookie Policy

The Site uses cookies to record users' preferences in relation to the functionality of accessibility. We, our Affiliates, and our Vendors may store and access cookies on a device, and process personal data including unique identifiers sent by a device, to personalise content, tailor, and report on advertising and to analyse our traffic. By clicking “I’m fine with this”, you are allowing the use of these cookies. You may change your settings based on a legitimate interest at any time, by selecting “Manage Settings” on our site. Please refer to the help guide of your browser for further information on cookies, including how to disable them. Review our Privacy & Cookie Notice.