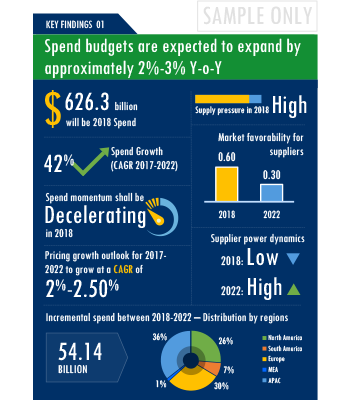

The report provides a comprehensive coverage on High Value Home Products Insurance category spend growth and regional spend segmentation insights, High Value Home Products Insurance price trends and High Value Home Products Insurance supply market analysis.

GET FREE SAMPLEEcosystem of the global High Value Home Products Insurance category is intertwined with the larger parent market of Financial. Our category definition describes that overall Financial market includes all spend related to the provision of financial services used to fill a skills gap for the defined subject areas where the service requirement includes delivery or implementation.

Financial market around the world is undergoing rapid transitions that have a massive potential to influence the way companies strategize for High Value Home Products Insurance procurement and the cost they have to incur. Many suppliers are investing in automation technologies such as AI, robotics, machine learning and big data to optimize their business operations and offer new services to their customers. However, a part of this investment is also passed to buyers in the form of high prices being charged for value added services. Talent pools available to suppliers of High Value Home Products Insurance are gradually getting costlier, impacting their OPEX. Suppliers are compelled to change their pricing structure and pass on some of this cost increase to their customers. Suppliers are introducing self-service tools such as virtual agents in their customer service ecosystem to reduce the time and costs incurred by customers to resolve an issue.

Sometimes, procurement functions are unable to timely alter their practices while responding to market conditions. Industry experts acknowledge that periodically reviewing procurement best practices and adopting learnings from across procurement categories can help procurement teams respond to market needs in a more agile way. This report combines our experience of other categories with High Value Home Products Insurance procurement insights and hand picks best practices that can work for category managers delving in this market. For example, Cost saving opportunities may reduce exponentially in relation to the time left for current contract to expire or required timeline to start the engagement. Therefore sufficient interval should exist between initation of new procurement and expected start date of the new contract for High Value Home Products Insurance. Buyers should engage with service providers that provide AFA in their pricing as negotiating on an hourly basis can increase the procurement cost of buyers due to overruns within lawsuits. AFA also provides buyers with cost predictability, certainty, and transparency. There are increased exposure risks of confidential data such as product and service information, operations, and customer information when engaging a third-party supplier. Buyers must engage with suppliers that use encryption technologies, password protection, access control solutions, and proper training schedules to prevent possible information breach.

Activate your free account to gain easy access to cutting edge research and insights on consumers, emerging price trends, global and regional suppliers.

High Value Home Products Insurance procurement managers also need to proactively identify and mitigate potential risks that can arise in the supply chain or contracts for High Value Home Products Insurance procurement. Some examples include:

For detailed insights and complete access to our report library, activate your free account!

The report is intended to serve as a one-stop reference guide for High Value Home Products Insurance procurement strategy and offers a perfect blend of category basics with deep-dive category data and insights. Therefore, it is ideal for category beginners looking for “High Value Home Products Insurance: Procurement Report 101” as well as for category experts actively tracking the global High Value Home Products Insurance procurement market.

You may have just initiated your research to design a winning High Value Home Products Insurance procurement strategy, or you may be a category expert looking for strategic insights and updated data.Either ways, the report has your requirements covered.

Unlock SpendEdge's comprehensive procurement report collection with ease through our procurement platform.

Procurement decisions can prove to be costly in the absence of careful deliberation and evaluation of every available option. In fact, more than 90% of the decision makers we work with acknowledge that timely availability of up-to-date category intelligence can help them make better purchasing decisions. More than 80% of them believe that in-house category intelligence needs to be updated periodically to achieve full benefits. If you have read so far, we are quite sure you agree!!

The High Value Home Products Insurance procurement report helps take more informed decisions by placing all the critical information and advice at the fingertips of a decision maker. It also specifically answers some of the key questions that we have been routinely asked during our industry outreach initiatives:

SpendEdge Insights has helped procurement professionals and sourcing teams manage multiple spend areas and achieve more than $2 billion in savings. Activate your free account today!

The High Value Home Products Insurance market report offers a complete picture of the supply market and analyzes the category from the perspective of both buyers and suppliers. Analysis of the category trends, procurement best practices, negotiation levers and overall category management strategy advisory are interspersed with in-depth data and commentary on spend outlook, pricing ecosystem and supplier landscape drilled down to a region-level coverage.

A key highlight of this report is the in-depth outlook created on High Value Home Products Insurance procurement spend and pricing trends. The report further delves deep into the aspects of cost structure, total cost of ownership and supplier margins for High Value Home Products Insurance. A dedicated section to supplier profiles and evaluation helps decision makers cast a wider procurement net and identify gaps in existing relationships.

Along with specific category and supplier intelligence, the publication also includes curated insights on High Value Home Products Insurance market trends, price influencers and inherent risks. These insights help the decision makers prepare for market shaping trends in advance and create alternative strategies for changes in the market conditions.

Additionally, the report also advises on the best practices and strategies to manage the High Value Home Products Insurance category efficiently. Negotiation levers and opportunities are explained in detail along with quantification of their potential. Benchmark KPIs for supplier and buyer performance management are also aggregated to better organize the category objectives. Other themes of advisory include ideal procurement organization structure, enablers to achieve KPIs or category objectives and ideal SLAs to have with suppliers.

Our research is complex, but our reports are easy to digest. Quantitative analysis and exhaustive commentary is placed in an easy to read format that gives you an in-depth knowledge on the category without spending hours to figure out “what does it mean for my company?”

SpendEdge presents a detailed picture of High Value Home Products Insurance procurement solutions by way of study, synthesis, and summation of data from multiple sources. The analysts have presented the various facets of the market with a particular focus on identifying the key category influencers. The data thus presented is comprehensive, reliable, and the result of extensive research, both primary and secondary.

Global Terrorism Insurance and Liability Market - Procurement Intelligence Report

Global Commercial Auto and Truck Insurance Market - Procurement Intelligence Report

Global Product Liability Market - Procurement Intelligence Report

Global Clinical Trials Insurance Market - Procurement Intelligence Report

Global Corporate General Liability Insurance Market - Procurement Intelligence Report

Global Insurance Benefits Services Market - Procurement Intelligence Report

Global Critical Illness Insurance Market - Procurement Intelligence Report

Global Property Insurance Market - Procurement Intelligence Report

Global Marine Insurance Market - Procurement Intelligence Report

Access this report and our entire procurement platform | Plans starting from USD 3000/ Year Buy Now

Copyright © 2025 Infiniti Research Limited. All Rights Reserved. Privacy Notice – Terms of Use – Sales and Subscription

Cookie Policy

The Site uses cookies to record users' preferences in relation to the functionality of accessibility. We, our Affiliates, and our Vendors may store and access cookies on a device, and process personal data including unique identifiers sent by a device, to personalise content, tailor, and report on advertising and to analyse our traffic. By clicking “I’m fine with this”, you are allowing the use of these cookies. You may change your settings based on a legitimate interest at any time, by selecting “Manage Settings” on our site. Please refer to the help guide of your browser for further information on cookies, including how to disable them. Review our Privacy & Cookie Notice.