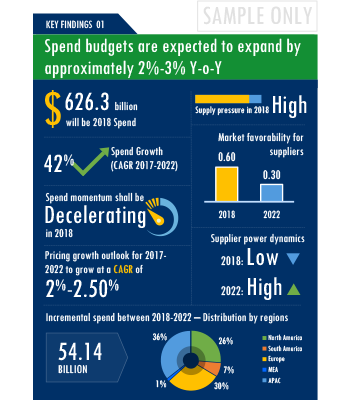

The report provides a comprehensive coverage on Life Assurance category spend growth and regional spend segmentation insights, Life Assurance price trends and Life Assurance supply market analysis.

GET FREE SAMPLELife Assurance is an essential part of the HR Services category which includes all spend related to HR services delivery relating to staff of the organization spanning the entire employee lifecycle - from the hiring process to the retirement process.

HR Services market around the world is undergoing rapid transitions that have a massive potential to influence the way companies strategize for Life Assurance procurement and the cost they have to incur. People analytics has emerged as a rather new branch of HR function with an aim to gain deeper insights into an employee's behavior, motivators, risk of attrition and general wellbeing. There is a high demand for suppliers who can integrated technology in traditional processes to generate insights on the buyers' talent pool. Even though global population is increasing, the availability of adequately trained talent pool is reducing in many geographies. Lack of skilled in-house manpower continues to be the largest factor for hiring of Life Assurance. Companies are designing processes where the internal talent can work on the most value-adding activities and all non-core activities can be handed over to a third-party. New locations and vendors are emerging as cost effective suppliers of Life Assurance, offering an opportunity to widen the supplier base and gain further negotiation leverage with incumbent suppliers.

It has become imperative for category managers to remain as agile as possible in terms of their procurement practices. However, it is not always easy to quickly spot and implement alternative practices in a category like Life Assurance. To help quick decision making, this report advises on several procurement best practices that have worked well for category managers. For example, Besides shortlisting potential suppliers based on services offered and cost, they also need to be evaluated against several other critical parameters. Some examples of these parameters are compliance with laws and regulations, capability to protect personally identifiable information and technical standards adopted (e.g. user interface, user exchange standards, data exchange standards). RFPs soliciting the above information ensures competition among suppliers and facilitates efficient evaluation.Employees prefer flexibility and have customized requirements when it comes to choosing or accessing the benefits/services available to them. Service providers must also develop flexible plans and administration processes that can cater to unique demands of an increasingly diversified workforce.Employers are focusing on providing employee-friendly interfaces (such as mobile-enabled services and web portals) to access and manage benefits and options available to employees. Suppliers who have the technical capabilities to seamlessly integrate with the employer's internal systems without comprising the data protection should be preferred.

Activate your free account to gain easy access to cutting edge research and insights on consumers, emerging price trends, global and regional suppliers.

Life Assurance procurement managers also need to proactively identify and mitigate potential risks that can arise in the supply chain or contracts for Life Assurance procurement. Some examples include:

For detailed insights and complete access to our report library, activate your free account!

The report is intended to serve as a one-stop reference guide for Life Assurance procurement strategy and offers a perfect blend of category basics with deep-dive category data and insights. Therefore, it is ideal for category beginners looking for “Life Assurance: Procurement Report 101” as well as for category experts actively tracking the global Life Assurance procurement market.

You may have just initiated your research to design a winning Life Assurance procurement strategy, or you may be a category expert looking for strategic insights and updated data.Either ways, the report has your requirements covered.

Unlock SpendEdge's comprehensive procurement report collection with ease through our procurement platform.

Procurement decisions can prove to be costly in the absence of careful deliberation and evaluation of every available option. In fact, more than 90% of the decision makers we work with acknowledge that timely availability of up-to-date category intelligence can help them make better purchasing decisions. More than 80% of them believe that in-house category intelligence needs to be updated periodically to achieve full benefits. If you have read so far, we are quite sure you agree!!

The Life Assurance procurement report helps take more informed decisions by placing all the critical information and advice at the fingertips of a decision maker. It also specifically answers some of the key questions that we have been routinely asked during our industry outreach initiatives:

SpendEdge Insights has helped procurement professionals and sourcing teams manage multiple spend areas and achieve more than $2 billion in savings. Activate your free account today!

The Life Assurance market report offers a complete picture of the supply market and analyzes the category from the perspective of both buyers and suppliers. Analysis of the category trends, procurement best practices, negotiation levers and overall category management strategy advisory are interspersed with in-depth data and commentary on spend outlook, pricing ecosystem and supplier landscape drilled down to a region-level coverage.

A key highlight of this report is the in-depth outlook created on Life Assurance procurement spend and pricing trends. The report further delves deep into the aspects of cost structure, total cost of ownership and supplier margins for Life Assurance. A dedicated section to supplier profiles and evaluation helps decision makers cast a wider procurement net and identify gaps in existing relationships.

Along with specific category and supplier intelligence, the publication also includes curated insights on Life Assurance market trends, price influencers and inherent risks. These insights help the decision makers prepare for market shaping trends in advance and create alternative strategies for changes in the market conditions.

Additionally, the report also advises on the best practices and strategies to manage the Life Assurance category efficiently. Negotiation levers and opportunities are explained in detail along with quantification of their potential. Benchmark KPIs for supplier and buyer performance management are also aggregated to better organize the category objectives. Other themes of advisory include ideal procurement organization structure, enablers to achieve KPIs or category objectives and ideal SLAs to have with suppliers.

Our research is complex, but our reports are easy to digest. Quantitative analysis and exhaustive commentary is placed in an easy to read format that gives you an in-depth knowledge on the category without spending hours to figure out “what does it mean for my company?”

SpendEdge presents a detailed picture of Life Assurance procurement solutions by way of study, synthesis, and summation of data from multiple sources. The analysts have presented the various facets of the market with a particular focus on identifying the key category influencers. The data thus presented is comprehensive, reliable, and the result of extensive research, both primary and secondary.

Global Retirement Savings Plan Administration Market - Procurement Intelligence Report

Global Compensation Management Services Market - Procurement Intelligence Report

Global Flexible Benefits Administration Market - Procurement Intelligence Report

Global Miscellaneous Employee Benefits and Services Market - Procurement Intelligence Report

Global Spouse Partner Life Assurance Market - Procurement Intelligence Report

Global Compensation Or Benefits Planning Market - Procurement Intelligence Report

Global Promotion Fulfillment Services Market - Procurement Intelligence Report

Global Company Car Provisions And Services Market - Procurement Intelligence Report

Global Vouchers Market - Procurement Intelligence Report

Access this report and our entire procurement platform | Plans starting from USD 3000/ Year Buy Now

Copyright © 2025 Infiniti Research Limited. All Rights Reserved. Privacy Notice – Terms of Use – Sales and Subscription

Cookie Policy

The Site uses cookies to record users' preferences in relation to the functionality of accessibility. We, our Affiliates, and our Vendors may store and access cookies on a device, and process personal data including unique identifiers sent by a device, to personalise content, tailor, and report on advertising and to analyse our traffic. By clicking “I’m fine with this”, you are allowing the use of these cookies. You may change your settings based on a legitimate interest at any time, by selecting “Manage Settings” on our site. Please refer to the help guide of your browser for further information on cookies, including how to disable them. Review our Privacy & Cookie Notice.